This Tax Calculator Will Tell You If It’s Worth It To Get Married

Goin’ to the chapel and we’re gonna get savings.

With tax season in full swing, we’re all sweating those W2s, 1099s and deductions. One way to save money you may not have considered? Marriage.

The relationship between marriage and tax benefits is a complicated one. The initial US tax structure was based on filing one return for one income. This was a sensible system when most families lived on just one income, but with the rise of two-income families, Congress introduced the joint return in 1948.

This new law opened the door to complaints from single workers who found it unfair that married couples received deductions for two people, even if they only had one household income. They claimed that this change effectively incentivized marriage, so Congress scaled down the joint deduction in 1969.

After adjusting the deduction, many couples chose to live together without getting married since two single filings offered more savings than the reduced joint filing—now essentially penalizing marriage. In 2001, Congress tweaked the code again to increase the deduction of a joint filing closer to the 1948 level.

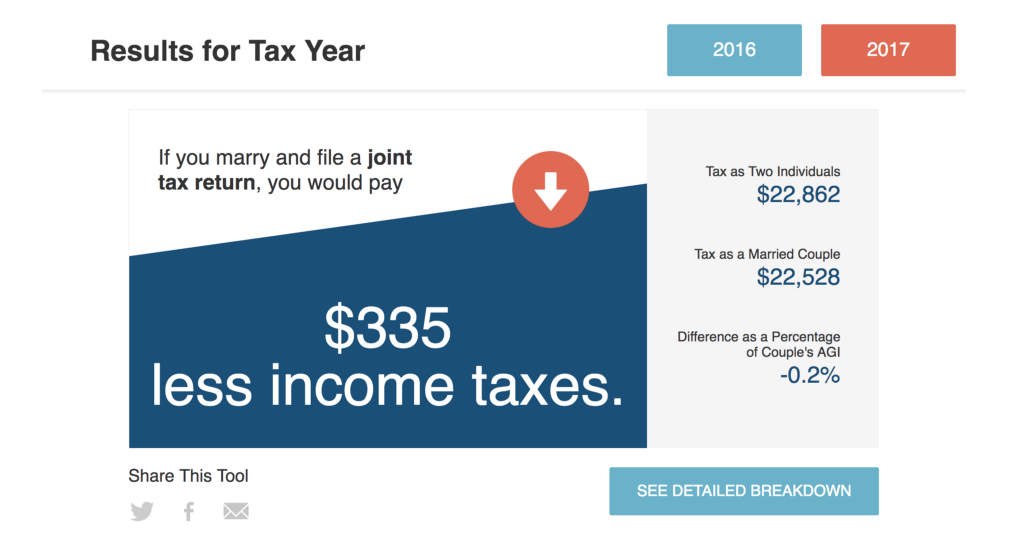

Today, joint filing as a married couple tends to offer more deductions, especially if you and your partner have only one income or a large income disparity. But rather than crunching all the numbers yourself to determine which option will save you the most dough, the Tax Policy Center developed a calculator to do the math for you. Simply enter your income and your partner’s, along with your expected deductions, and the calculator will estimate tax payments based on filing as individuals and as a couple.

According to the 2010 US Census, 7.6 million opposite-sex couples and 514,735 same-sex couples live together but aren’t married. So if you’re one half of an unmarried duo and you’re itching to tie the knot, maybe drop a tax break as a sensible, not-so-subtle hint toward marriage.